There are plenty of options available to help with covering day-to-day expenses, but AccrueMe Amazon funding was created to help Amazon Sellers truly Grow!

New Amazon Seller Funding with No Monthly Payments or Loss of Ownership

Any successful Amazon Seller knows that becoming profitable is only part of the battle. Once you have become a profitable merchant, the next challenge is to scale and grow your business to make significant amounts of money. But as all entrepreneurs learn quickly, it takes money to make money. To grow their business to the point where they can make a living, an Amazon Seller needs growth capital.

Acquiring capital from external sources has always been possible, but there are many significant risks and restrictions with the traditional models. The burdens of monthly payments, high-interest rates, and ownership loss can slow business growth and cost you your independence. Furthermore, many of the companies that currently offer capital are simply offering an advance on capital the Seller has already earned in exchange for skimming a percentage off the top, making that capital the exact opposite of growth capital.

This is the problem that AccrueMe has set out to solve with its innovative, unprecedented model for providing Amazon FBA Sellers with true growth capital. AccrueMe is offering true Amazon funding without interest fees, monthly payments, loss of ownership in your business, or being personally liable. AccrueMe becomes your temporary partner, leveraging its significant sources of funding and its founding team’s decades of entrepreneurial and deal-making experience and allowing you to use the company’s capital, business tools, and consulting to help grow your business in exchange for a small, temporary share of the profits. Once you no longer need AccrueMe’s Amazon capital, you simply repay them their capital and their profit share, and then they’re out— you keep 100% of the profits of your newly-scaled business from there. And because AccrueMe only takes shares of the profits, they only make money when you do.

How does AccrueMe work?

AccrueMe provides true growth capital to successful Amazon Sellers. AccrueMe provides an amount of capital up to the amount the Seller already has invested in their business, meaning AccrueMe will bring themselves up to 50% of the total capital invested (including AccrueMe’s temporary investment). In exchange, AccrueMe receives a TEMPORARY profit share equaling half of their contribution to the capital pie (so if they match a Seller’s capital and are now providing 50% of the total capital, they get half of 50, or 25%, of the profits for a temporary period). We will see a detailed example of how the math works out a little later on.

AccrueMe relies on the seller’s ability to make a profit. If the seller does not generate a profit, then AccrueMe makes no money. This means AccrueMe, unlike other funding companies that charge interest and have fixed monthly payments, is fully driven to help the Seller succeed. AccrueMe does not require interest, fees, monthly payments, or any permanent loss of equity in the Seller’s business.

In addition to growth capital, AccrueMe offers Sellers consulting, mentorship, and numerical analysis using its proprietary software and the team’s years of business experience in order to help the Sellers maximize their profits. AccrueMe’s software analysis and business consulting aid the seller in making inventory purchase decisions and developing seller inventory portfolios for maximum profit.

What kind of Amazon Sellers use AccrueMe?

Because AccrueMe only makes a profit when the seller makes a profit, AccrueMe must be selective when it comes to partnering with entrepreneurs to provide Amazon funding. After all, a win-win only works for one side when it works for the other side! Because of this, AccrueMe sets some criteria for its Amazon Seller partners, who must:

• Have been profitably selling on Amazon for at least six months

• Have strong performance metrics and be in good standing with Amazon

• Have at least $10,000 invested in their business

• Be an FBA Seller on Amazon US (but they can be located anywhere)

By partnering with experienced, vetted Sellers, AccrueMe stays true to its win-win philosophy. This leads to great results for both sides. Consider this actual Seller example:

• AccrueMe invested $25,000 in an Amazon Seller in Q2 of 2019 (equaling the seller’s capital)

• In Q2 of 2019, the Amazon Seller generated $51,532.42 in revenue and $4,986.27 in net profit.

• In Q2 of 2020, the Amazon Seller generated $224,153.58 in revenue and $41,733.87 in net profit.

As you can see, AccrueMe was able to lead its partner to 4x revenue growth and 8x profit growth in just one year. Even after paying AccrueMe its profit share and its initial investment, the seller still earned 6x the profit they did the year before. And once the Seller repaid AccrueMe, they could now enjoy their newly-grown business and those increase profits forever, WITHOUT ever having to share profits with AccrueMe again. Remember, even though the benefits are permanent, the partnership with AccrueMe (and the profit share) is only temporary! This worked for both sides because the seller had an already profitable business model with great suppliers and great products, and the added Amazon funding provided by AccrueMe true growth capital allowed the seller to buy more inventory and grow rapidly.

How much does AccrueMe cost?

AccrueMe should not cost the Seller anything out of pocket. This is because AccrueMe doesn’t charge interest or fees, it only receives a share of the profits. This profit share is between 5% and 25%— equal to half the percentage of the capital AccrueMe has put into the business. Sellers have the option to pay AccrueMe any amount they wish at the end of a month, or simply keep the capital invested in their business to continue increasing profits. If you reinvest the profits each month and grow your Amazon capital in the business, AccrueMe’s capital % goes down, which means the percentage of profits you have to share with AccrueMe goes down over time. AccrueMe will also contribute more Amazon funding when asked, as long as it is used to buy more inventory. And whenever you’re ready, you can pay AccrueMe its initial investment and the share of profits it has earned while you’ve been using their capital (which will be less than the amount of money AccrueMe helped you bring in), and then go back to keeping 100% of the profits for yourself.

Most funding sources DO cost the Seller money, because the Seller is paying interest and fees, or a percentage of their own money, in exchange for receiving that amount of money a little bit early. But AccrueMe doesn’t just take a piece of the pie it helps you grow the pie tremendously first, using the power of growth capital and compounding gains. Let’s take a look at how the Amazon funding works.

AccrueMe Amazon Seller Funding Example

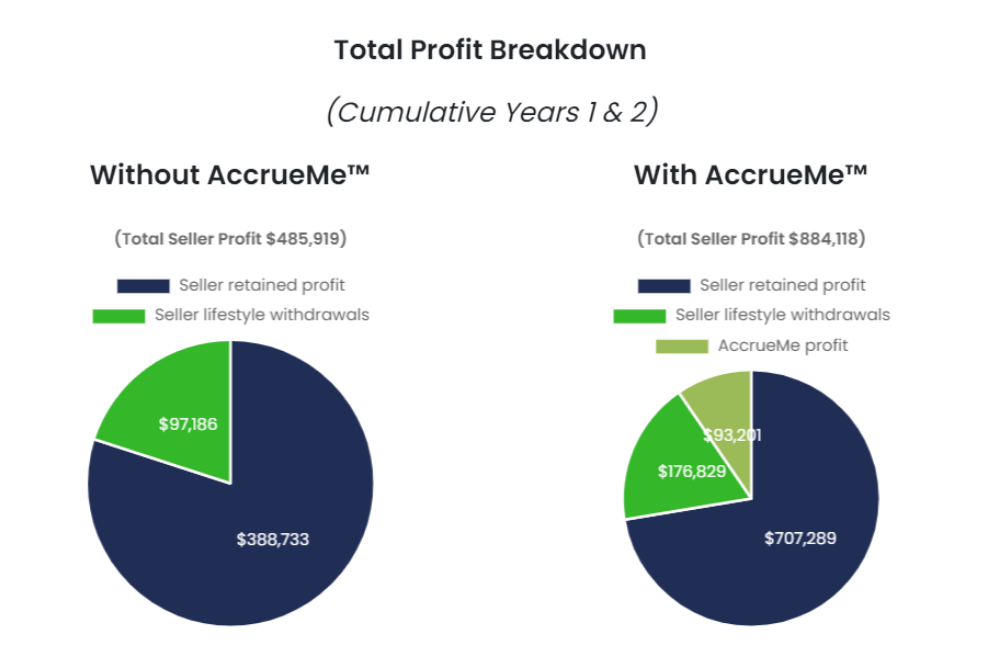

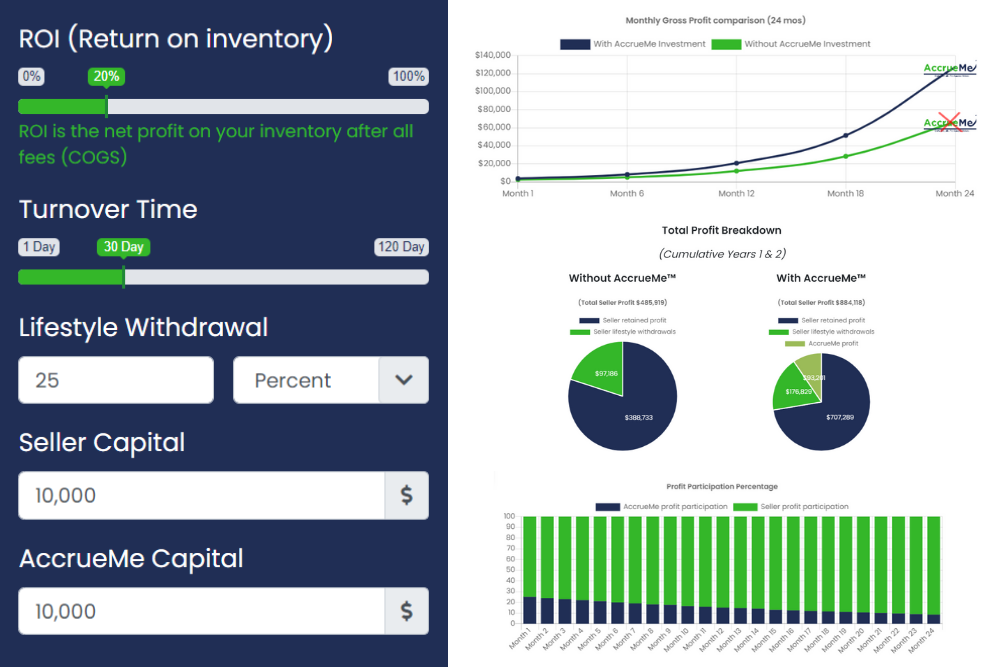

Assume a seller is making a 20% Return on Investment (which means you make $120 in revenue for every $100 you spend) with a 30-day inventory turnover time on $100,000 invested capital, which gets matched by AccrueMe to bring the total capital to $200,000. A 20% ROI means $120,000 in revenue ($20K profit) on $100K of COGS, so assume a $240K revenue ($40K profit) on $200K of COGS after an AccrueMe investment. That creates a $20K profit increase, which becomes an extra monthly $10K in the Seller’s pocket after accounting for AccrueMe’s 25% share that month. Without compounding gains, that extra $10K per month would make the Seller an extra $240K worth of profit after 2 years. However, as we’ll see, the benefit to the Seller is much higher than the above numbers, because of the magic of compounding gains.

What are compounding gains?

Compounding gains happen when the increased money available to the Seller generates even more money on its own because the Seller can keep and invest it instead of paying it immediately to AccrueMe. To understand this, consider that the Seller can keep some or all of that $240K revenue from month 1 in the business instead of making a monthly payment to AccrueMe. This means the 2nd month (with the same 20% ROI) would see $48,000 profit on $240K capital, and month 3 would bring $57,600 profit on $288K capital. Even accounting for the profit share owed to AccrueMe, by month 6 the Seller has leveraged compounding returns and increased scale to bring their personal monthly profits from $20K to well over $50K per month!

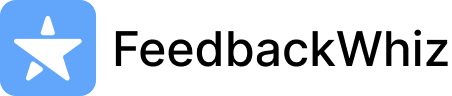

Furthermore, as the Seller’s revenue grows, the money provided by AccrueMe represents a smaller and smaller percentage of the total capital, meaning the Seller’s profit share percentage owed to AccrueMe decreases over time. In this example, by month 24, AccrueMe’s share of the monthly profits has decreased from 25% all the way down to just over 5%. And once the Seller returns AccrueMe’s investment plus accrued profits, the Seller is permanently entitled to keep 100% of monthly profits going forward profits which may be nearing $2M/mo by the end of month 24 when you continue doing the math.

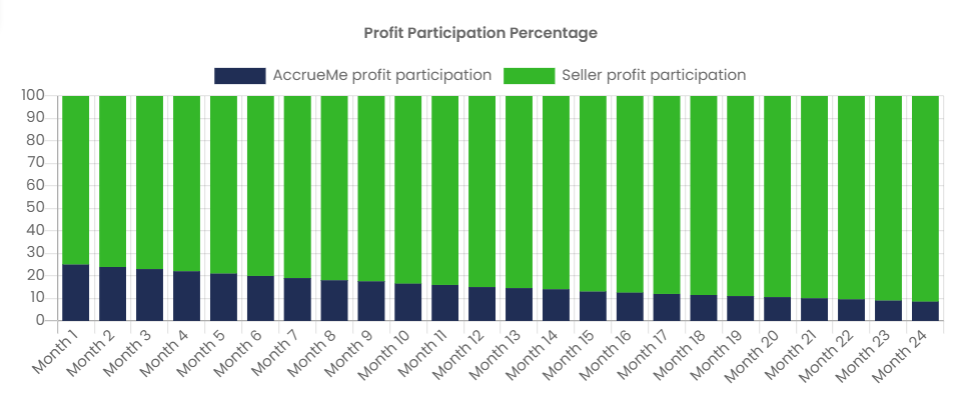

24 months of a $20K profit increase at 25% profit share would mean an extra $240K after 2 years. But due to compound gains and diminishing profit share, the Seller’s business has actually earned an extra $7 Million by the end of month 24 than they would have without AccrueMe.

This math assumes the Seller is keeping all the Amazon funding in the business. However, if the Seller chooses to make monthly lifestyle withdrawals of 15%, they still have an additional $5.7 Million in their business by the end of month 24, and an additional $1.6M in their own pocket.

The AccrueMe Amazon seller calculator allows you to change any of these numbers (Seller capital, AccrueMe capital, ROI, Lifestyle withdrawals, Turnover time) if you wish to experiment with different numbers and see how your profits could increase with AccrueMe Amazon funding.

How is AccrueMe different from other funding providers?

AccrueMe is different because it truly embraces the win-win model. Unlike other companies, a partnership with AccrueMe enables true growth, because the Seller is receiving a true infusion of Amazon funding that they can invest in growing their business, rather than a loan or an advance on the money they have already earned for which they will have to pay interest. Additionally, Sellers can invest the profits they earn from AccrueMe’s capital infusion to create an even bigger growth in profits because they do not have to write AccrueMe a check at the end of each month. This is why, as shown in the mathematical example above and in the Calculator on AccrueMe’s website, a partnership with AccrueMe can generate incredible amounts of profit in relatively short amounts of time.

Furthermore, unlike other sources of funding, AccrueMe is completely invested in Seller success, because the profit-share model (as opposed to an interest model or a loan) means AccrueMe only profits when the Seller profits. This is why AccrueMe offers support, analysis, and guidance, not just money.

Finally, a partnership with AccrueMe is a temporary arrangement. Sellers can pay AccrueMe Amazon funding at any time, or continue the relationship as long as they need the capital. Once the investment and profit share are paid, the relationship with AccrueMe is over. This is a stark difference from other funding sources who make it very difficult to escape the arrangement.

How much money does AccrueMe have available to invest?

As of August 25, 2020, AccrueMe has committed to providing a total of $100 million in Amazon funding to Amazon Sellers. This large amount of available funds means there is plenty of opportunity for Amazon Sellers who meet AccrueMe’s investment criteria.

AccrueMe’s ultimate goal is to become the preferred source of capital for Amazon Sellers who want to scale their business. In the future, AccrueMe plans to expand to other platforms, but at the moment the company is solely focusing on Amazon Sellers.

How did AccrueMe get into funding Amazon sellers?

AccrueMe was founded by Don Henig and Eric Kotch, who had spent over twenty years working successfully and often as friendly competitors in the New York mortgage industry. After leaving the mortgage business, they got together one day for a catch-up and began discussing current business opportunities.

Naturally, the discussion quickly focused on Amazon and the needs of Amazon Sellers. Don and Eric looked at current lending opportunities for Sellers, but didn’t see a great benefit to the Sellers, who in the existing business models were often being asked to pay interest, make crippling and growth-slowing monthly payments, and even give up permanent partial ownership of their business.

Don and Eric then began brainstorming new funding options for Amazon sellers. Their entire premise was that whatever they decided to do, it had to be good for the Seller and also needed to be profitable for themselves. One without the other was of no interest. Don and Eric decided to build their new business on the premise that AccrueMe would only win when the seller wins. The two businessmen knew that successful win-win partnerships require mutual respect, trust, and a give-and-take mindset.

To apply these principles would mean a huge departure from traditional rules of investing and lending. That’s exactly what Don and Eric did, coming up with a system that provided true Amazon funding to sellers with no credit report, no personal guarantees, no monthly payments, no profit share the first 30 days, no long-term commitment, and no permanent loss of ownership required. Don and Eric ran financial models and confirmed their expectation that, if they chose only the right, most driven entrepreneurial partners only those committed to growth and who understood the true value of a win-win model they could create a profitable business while helping determined, business-savvy Amazon Sellers become more profitable themselves.

Are you ready for an Amazon Funding Partner?

AccrueMe is completely unique in the Amazon funding space because it is the only company offering true growth capital and leveraging compounding gains to offer a profitable profit-share model that allows Sellers to scale their businesses without requiring interest, fees, permanent loss of equity or ownership, credit checks, personal guarantees, or any sort of permanent obligation. This straightforward agreement is designed to be a true win-win arrangement that avoids many of the issues that frequently trip up a small business entrepreneur.

In addition to the financial benefits of AccrueMe’s model, having a supportive and highly experienced team of investors, analysts, and entrepreneurs behind you for advice and consultation is extremely advantageous, especially to an individual seller.

If you meet the criteria to work with AccrueMe and you are looking for Amazon seller funding or capital to help take your profitable Amazon business to the next level, AccrueMe is ready to work with you. AccrueMe is ready to infuse millions of dollars into Amazon businesses.

0 Comments